Mergers and acquisitions are a regular part of the lifecycle of many businesses, especially those owned by private equity firms. While the process of acquiring (or being acquired) is a complex one, keeping or building a strong united brand doesn’t have to be. In fact, the process of combining brands and businesses presents an incredible opportunity for all parties involved to emerge stronger and more relevant to their customers and the market at large.

In our experience helping PE-backed companies navigate acquisitions, we’ve found the key to success is to ensure that brand positioning remains a central part of your acquisition strategy and not an afterthought.

- Evaluate Each Brand’s Equity

- Identify Your New Brand Architecture

- Get Your Story Straight

- Update Brand Identity and Collateral

- Audit Your Combined Marketing Capabilities

- Build Your Marketing Roadmap

- Craft Your Communication Plan

We hope this checklist can help you execute a smooth acquisition that results in a strong and lasting brand.

Evaluate Each Brand’s Equity

Before acquiring a company, it’s important to get a clear picture of the value of the company’s brand to its customers and the marketplace. We consider this a crucial part of the due diligence process as it informs how the brand should be integrated into the structure of the existing organization.

We’ve walked through this process with companies large and small, and while the details may vary, we encourage brands to work through the same key questions:

- What makes this brand relevant to its customers? Why do they do business with this brand instead of its competitors?

- What trends can we see in their customer engagement? Are they growing in brand equity or losing relevance?

- Does this brand’s reputation add or detract from other companies?

- If acquired, should the brand name be maintained or folded into another company?

- What can the target company add to our marketing capabilities?

- What investment will be needed to position this brand for success?

- How will this company be perceived by future buyers?

Beyond balance sheets and tax records, a thorough brand equity audit will help PE decision-makers evaluate the likelihood of a strong match with their portfolio.

Identify Your New Brand Architecture

Informed by an understanding of brand equity, you can next address brand architecture. Will the acquired company remain a standalone brand or should it be integrated into your existing brand? This question should be at the foundation (pun intended) of your brand strategy moving forward.

A few things to consider:

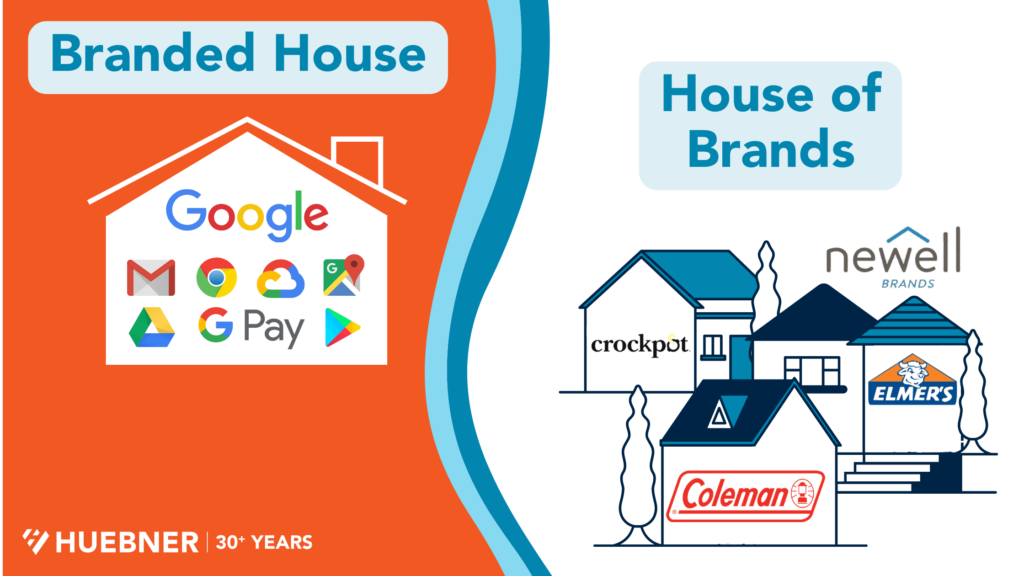

- If your new acquisition adds capabilities or products but doesn’t have brand equity to maintain, you might consider a Branded House model, rolling the new brand into your existing corporate brand.

- If the new acquisition does have a strong brand name and reputation you wish to maintain, then a House of Brands may be appropriate. In this case, you might even consider adding an umbrella brand or holding company to tie your brands together in a unified story.

As you consider an acquisition, the right Brand Architecture model will position your growing company to remain relevant to each and every customer and will support continued growth in the future.

Get Your Story Straight

The rationale behind a merger or acquisition needs to be explored as a part of each brand’s story. What combined vision or mission do these companies share? What capabilities does the new company add to the organization as a whole? And how does this merger better the lives of the company’s stakeholders, employees, and most of all, its customers?

Clearly communicating that message to all involved parties can’t happen soon enough, but getting key stakeholders all on the same page about that message can be a challenge.

Here are a few steps to help guide that conversation:

- Write a new chapter: Try to define how this new brand fits in the larger company story. Is it a natural extension or will it require some creative thinking?

- Build out the story for key personas: How does the story change for employee of the new acquisition, the parent company, and other impacted parties?

- Accentuate the positive: Highlight increased efficiencies, new products or features, added locations, and other exciting changes the acquisition brings.

Update Brand Identity and Collateral

All of the work done up to now will inform the new brand’s visual identity. What makes the brand equitable, where the new brand fits into the architecture, and the story behind the acquisition inspires how that brand is now visually presented to the world.

Bring your new brand into the fold with an updated brand identity guide including logo, colors, fonts, and a styling guide for internal teams.

Here again, brand architecture matters. If the new brand stands alone in a House of Brands, it might be more equitable to keep the historic logo customers recognize. If the new brand is joining a Branded House, the new brand might benefit from incorporating a visual element of the larger house.

For example, when Google acquires a new company, they evaluate whether or not the visual identity of the acquired company will benefit from a branding makeover. When they acquired YouTube, the logo remained the same because visual recognition was already established. YouTube’s reputation didn’t need a visual affiliation with the Google parent brand; the brand gets its support behind the scenes.

Things to consider:

- Will the new identity will include any of the historical elements from the old brands?

- Where will the new identity be used (online, social media, apps, signage, vehicles, etc)?

- What type of logo is most suitable – eg logotype or logo symbol?

Once the new brand identity is established, don’t forget to incorporate it into all internal and external communications like landing pages, websites, corporate profiles, and sales materials.

Audit Your Combined Marketing Capabilities

A merger or acquisition will most likely bring new personnel and processes to the table. It’s important to get a clear picture of the new company’s marketing capabilities and strengths.

These questions can help guide that exploration:

- What are they currently doing / what’s working / what’s not working?

- What are top-of-mind ways to leverage the strength of the multiple brands with the incoming brand?

- How can existing mechanisms support their work?

- Is there any negative press or customer sentiment around the new company that needs to be dealt with?

- What ongoing initiatives are in progress that needs to continue or wind down?

Build Your Marketing Roadmap

Now it’s time to get tactical, and for us at Huebner, that means using an Agile methodology to get things done with speed and transparency.

Your marketing roadmap should include any and all tactics that could move the needle for your brand in the coming year. With that backlog in place, you can move quickly and iteratively towards the finish line.

A few steps we regularly recommend in a marketing roadmap for the early stages of an acquisition:

- Collect existing collateral and put it into one place to be accessed by the parent or holding company marketing team

- Collect new company email list to clean, scrub, and test

- Match to holding company segmentation format

- Audit paid media efforts (pause all paid media until the audit is complete)

- Identify key players for marketing engagement

- Schedule regular status meetings among marketing brands

- Audit social media and decide where it will be managed

- Audit organic SEO and website traffic patterns

Craft Your Communication Plan

When it comes time to roll out the new brand, a communication plan can be broken down into four simple steps: Who, What, When, and Why.

WHO?

Think of all the different groups impacted by the transition. Pain points and opportunities might vary between them.

- Current Customers of both companies

- Employees and Stakeholders

- Partners/Distributors/Resellers

- Press/Industry as a Whole

WHAT?

Develop key messages for each group. How does messaging change for each audience?

- Current customers need to know the story of the transition and how this partnership will benefit them

- Employees and stakeholders need talking points and headlines to use in emails & socials

- Partners/Distributors/Resellers need to know how to address pain points

- Press/Industry needs to celebrate the growth of the company

WHEN?

Identify the opportunities to inform each group. How can you get the message in front of them appropriately?

- Scheduled social media messages

- Press releases

- Paid media like sponsored content, pop-up messages, or advertising

Be sure to include a defined Transition Timeline in your messaging to keep everyone on the same page.

WHY?

Infuse your messaging with purpose. Get creative in sharing this important step in the future of your company.

- Press releases should have an accurate story with updated SEO backlinks

- Consider a customer survey audit to see how the new company aligns with the holding company

- Target new customers from parallel brands to emphasize new capabilities

- The holding company should reach out to employees, stakeholders, partners, and distributors to build confidence

The purpose of the communication plan is not just to make people aware of the transition but to inspire excitement about the future of the company and the strength this new acquisition brings.

Conclusion

While no two mergers or acquisitions are alike, each presents an incredible opportunity to strengthen every brand involved. For those navigating an acquisition from a marketing perspective, these key areas of focus can help guide you to a strong and lasting brand on the other side.